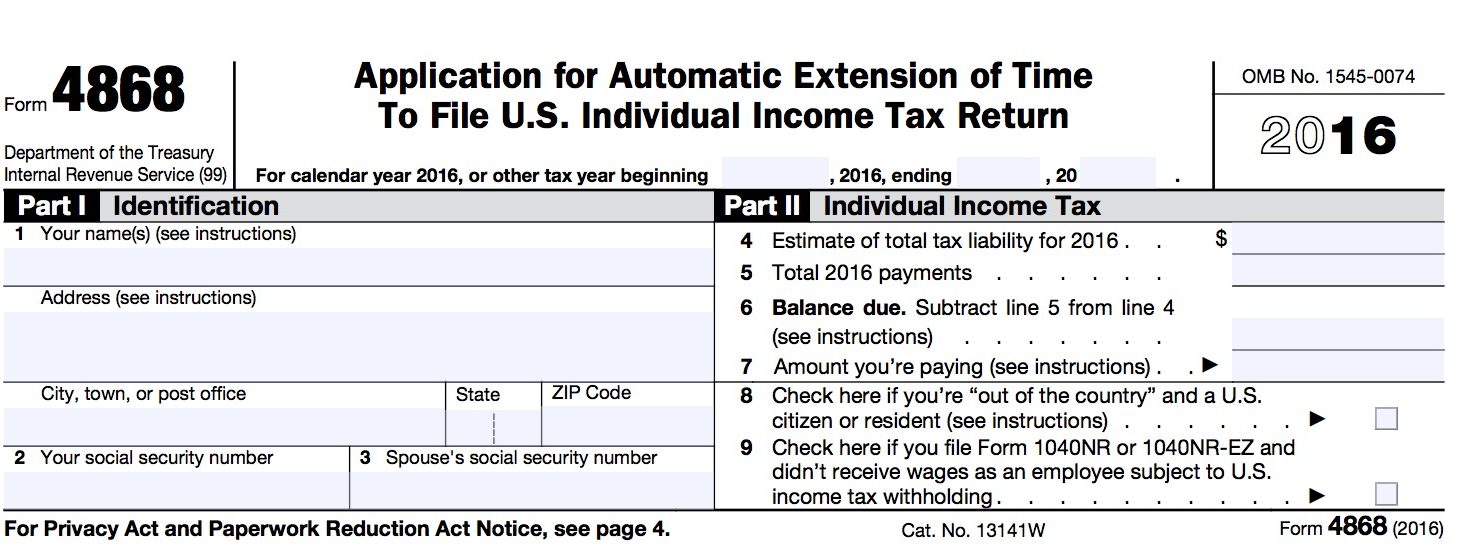

An extension of time to file is not an extension of time to pay any tax due.Ī late filing penalty of $25 will be charged for each month filed after March 15, 2020, up to $150.00 (6 months), even if no tax is due.Ī late payment penalty of 15% of the unpaid tax due will be charged if paid after the due date. Please forward a copy of the extension to our office. If you file a Federal extension, you will automatically receive a 6-month extension for filing. Examples include days worked out of city, employer error, or taxpayers under the age of 18. Full-year non-resident taxpayers requesting a refund should use the Application for Refund form found on the city’s website. The amount to be refunded must be greater than $10.00. If the tax balance due is $10.00 or less, no payment is required. Please include a copy of the Federal Form 1040/1040A/1040EZ to ensure your return is timely filed.

When filing your return, you are required to attach all W-2s and 1099-MISC forms. Please note that estimated payments are not mandatory in the City of Brunswick and a penalty will not be assessed for late payment of the estimate. These changes become effective with tax years beginning January 1, 2016.Ĭhanges regarding the declaration and payment of estimates for both individuals and businesses beginning with tax year 2016 are as follows:ĭue dates for quarterly payment of the declared estimate: Pursuant to the passage of Amended Substitute House Bill 5 by the Ohio General Assembly in December 2014, new State mandated municipal income tax guidelines have been established. Important income tax changes effective January 1, 2016

The tax credit will remain at 1.0% for wages taxed and paid for another city.

0 kommentar(er)

0 kommentar(er)